On May 6 of this year, the Securities and Exchange Commission opened applications for registering a company with a single shareholder. Preempted by the release of Republic Act 11232 or the Revised Corporation Code a few months ago, entrepreneurs welcomed this highly-anticipated development, which was long overdue.

In this article, we’ll talk about One Person Corporations (or OPCs as they are called) and when you should seriously consider it when starting your own business.

Sole Proprietorships vs. Corporations

Before OPCs came along, a person wanting to set up a business either has the option to register as a sole proprietor or find four other nominal shareholders to make up a corporation. The former was much simpler to set up while the latter protects the entrepreneur from personal liability arising from the business undertaking.

FullSuite Chief Strategist Maggie Po, who has been helping entrepreneurs and startups alike in setting up their business structure, has this to say about the two choices. “For a budding entrepreneur, these two options require a tradeoff between costs and risks. If you’re not in a position to spend money to set up your business, be willing and aware of the risks that comes with setting up a sole proprietorship- the biggest of which is that when things go horribly wrong, you are personally liable for the liabilities of the business and your personal assets are going to be exposed. To set up some sort of personal liability protection, you would have to find four other incorporators who would be willing to set up the business with you. Doing so requires extensive costs or dilution of your ownership and in some cases, both.”

If you’re an individual taking that giant leap into the wonderful and challenging world of entrepreneurship, simply going legal already requires you to weigh in on choosing between starting cheap and managing the risk or invest a good bulk of your starting capital to minimise future risks. It comes as no surprise that a lot of entrepreneurs are not making the decision to get registered right away.

And then comes a third option: the One Person Corporation (OPC).

Is it really a one-man show?

The OPC can be a total game-changer, as it provides the entrepreneur the ability to set up the business without additional incorporators (like a sole proprietorship) and at the same time, secure the protection that regular corporations enjoy.

An important thing to take note of, though, is that like a regular corporation, an OPC is required to identify a Treasurer and an OPC Secretary. Both positions are considered non-equity holding positions, meaning, whoever should hold these roles need not be a shareholder of the business.

The OPC owner may act as the Treasurer on record provided that he/she files a surety bond of at least One Million Pesos (PHP1M), renewable every two (2) years. This requirement may prove to be a deal breaker for an entrepreneur to choose the OPC option given that requires setting aside a material amount of its capital when it could be used to drive the business further.

Is OPC the right structure for you?

Finding the right structure for your business requires weighing both your present requirements and the future footprint of your business. As your business model reiterates and pivots, so would your need for a different legal structure in the future. The bigger question then is not on why you would set up an OPC when starting your business, but rather, when should you in lieu of opting for a sole proprietorship or a regular corporation.

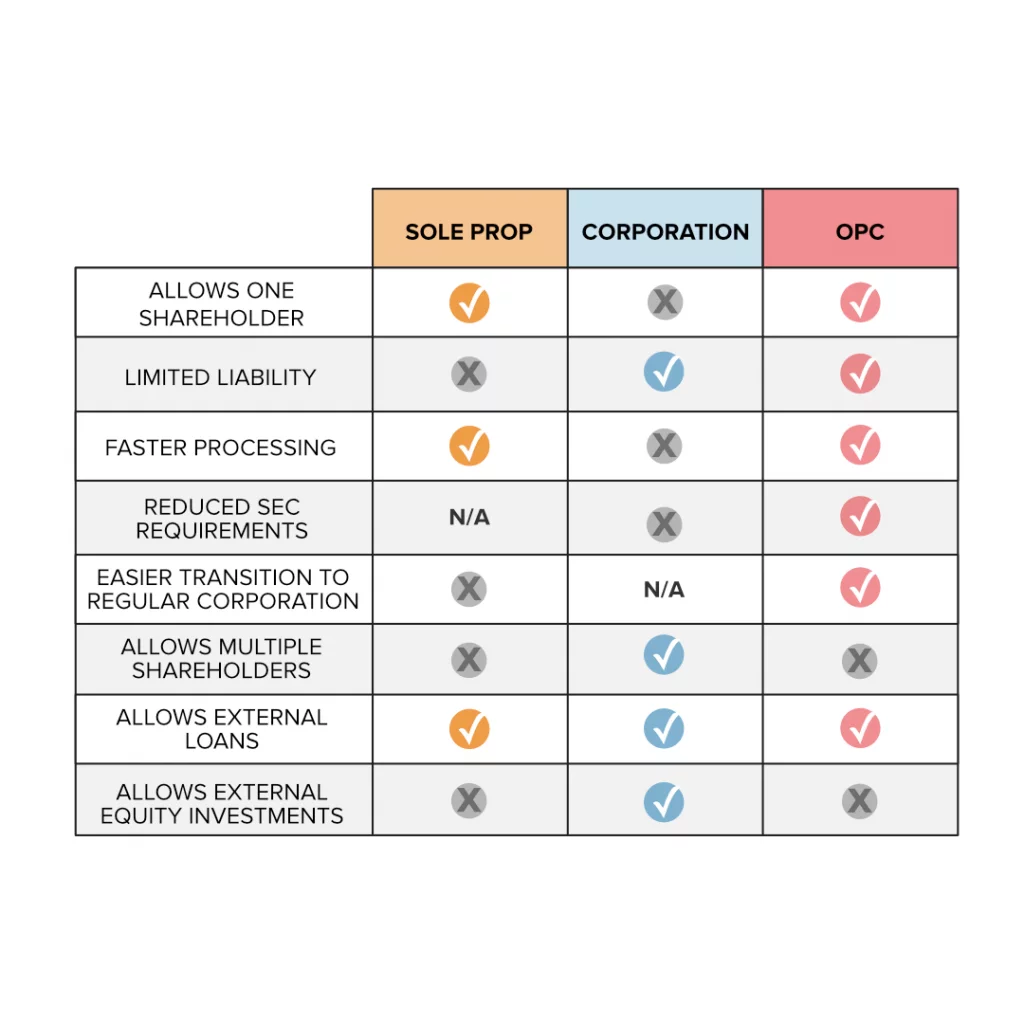

We have provided a quick pros and cons for each set up to further aid you in your decision to pick the right set up.

In conclusion

If you are starting a business on your own, has no immediate plans of raising additional capital from external parties, and wants to set up something fast but at the same time mitigate the risk of exposure to personal liability, OPC is the best structure to pursue at the current time. This will provide you the strong features of both a Sole Proprietorship and Corporation without incurring a lot of costs at the start.

The only thing to remember is that it may be a one-person corporation, but you would still need a non-shareholder to act as either the OPC Treasurer or OPC Secretary (or both). Handling the roles yourself requires a hefty surety bond that may not be reasonable at the stage of your business.

Should you need an expert assistance to discuss the legal structure of your venture, you may send an inquiry or set up an appointment with one of our legal structure experts through this link.