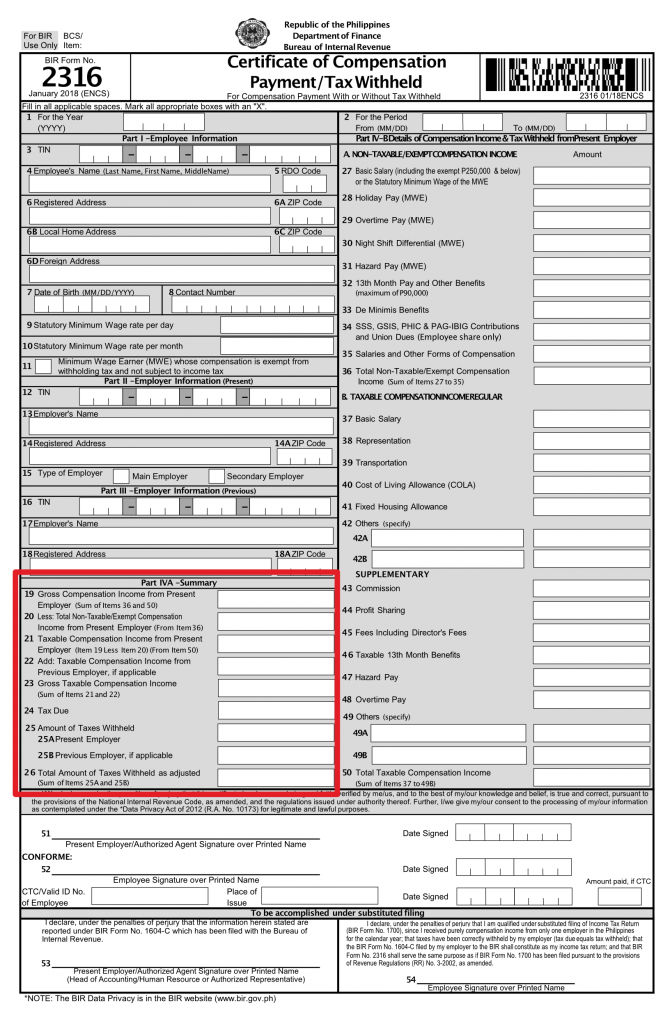

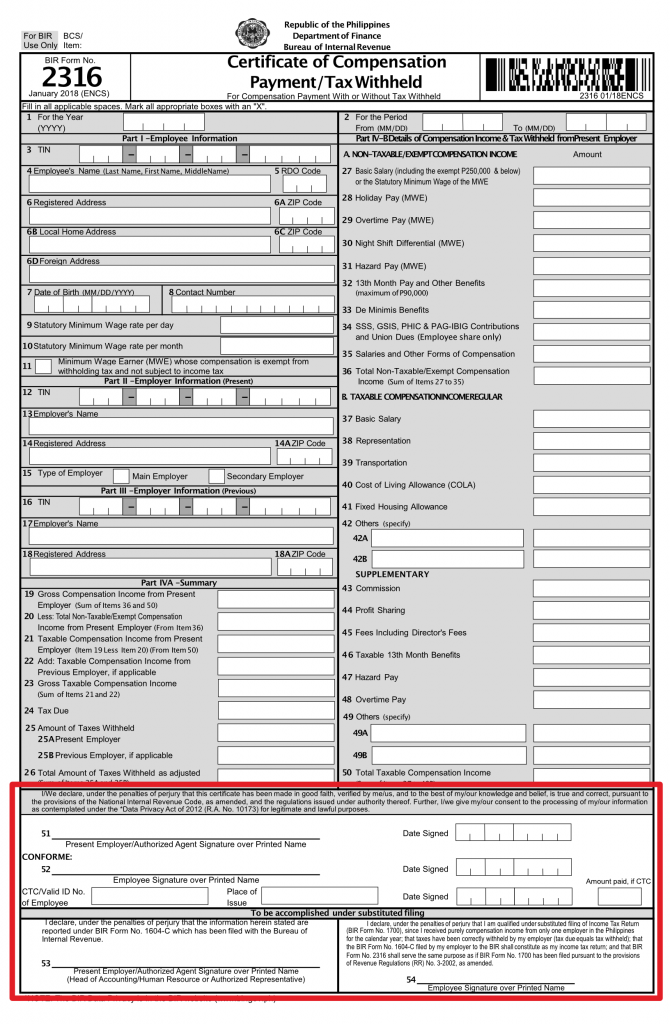

BIR requires the employer to withhold taxes from employee’s compensation based on the new train law that took effect at the start of 2018. As a proof of this withholding, employers are required to prepare and release BIR FORM 2316.

If you are an employee who has questions about your 2316, we crafted a useful guide for you in this separate article. Otherwise, if you are an employer who needs assistance on how to properly fill out BIR Form 2316, you have come to the right place. We will run you through when you need to prepare the form, the ways you can complete the form, and the steps to follow if you need to manually fill out Form 2316.

How often should you prepare and/or issue BIR Form 2316 to your employees

There are only two instances that you are required to prepare Form 2316: (1) when the employee resigned from your company or (2) after the annualization is done for your current employees or February 28th of the following year, whichever comes first.

You may issue a certified true copy of the final BIR Form 2316 every time your employee would require one. You should not issue BIR Form 2316 to any active employee during the year unless the annualization is done. If an employee requests for proof of income or financial capacity, you may release a copy of the previous year’s 2316 or a certificate of employment for the current year instead.

Where to find a copy of 2316 to issue to employees

You can secure a blank pdf copy of BIR FORM 2316 from the BIR website or by clicking this link and manually filling out. You can also generate a completed 2316 for your employees by using BIR’s Alphalist Data entry and validation module version 6.1 here.

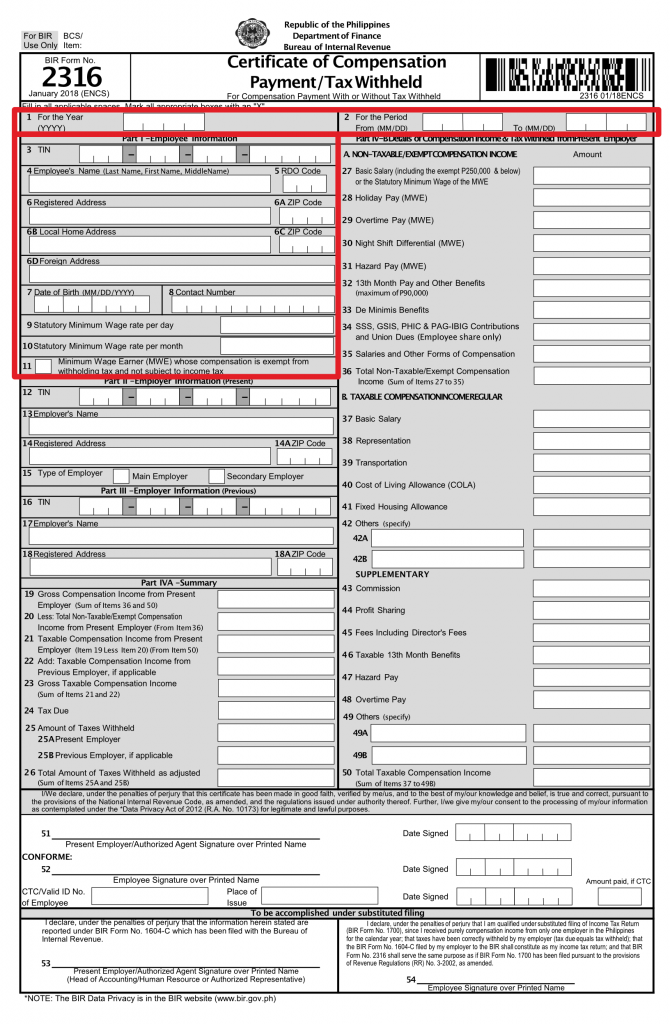

Filling out BIR Form 2316: Part I

In this section, we will discuss the first step of filling out the form.

- Ensure that you indicate the correct year (1) and the period (2). The period “FROM” should either be January 1st for all employees who joined your company before the current year. Otherwise, it should be the date of the hire date for new hires during the year. The period “TO” should be December 31st for all current employees or the resignation date for separated employees.

- Items 3, 4, 5, 6, 6A, 7, and 8 are required fields to fill out. Items 6B, 6C, and 6D should be filled out if applicable.

- Items 9 to 11 are applicable only if the employee is a minimum wage earner.

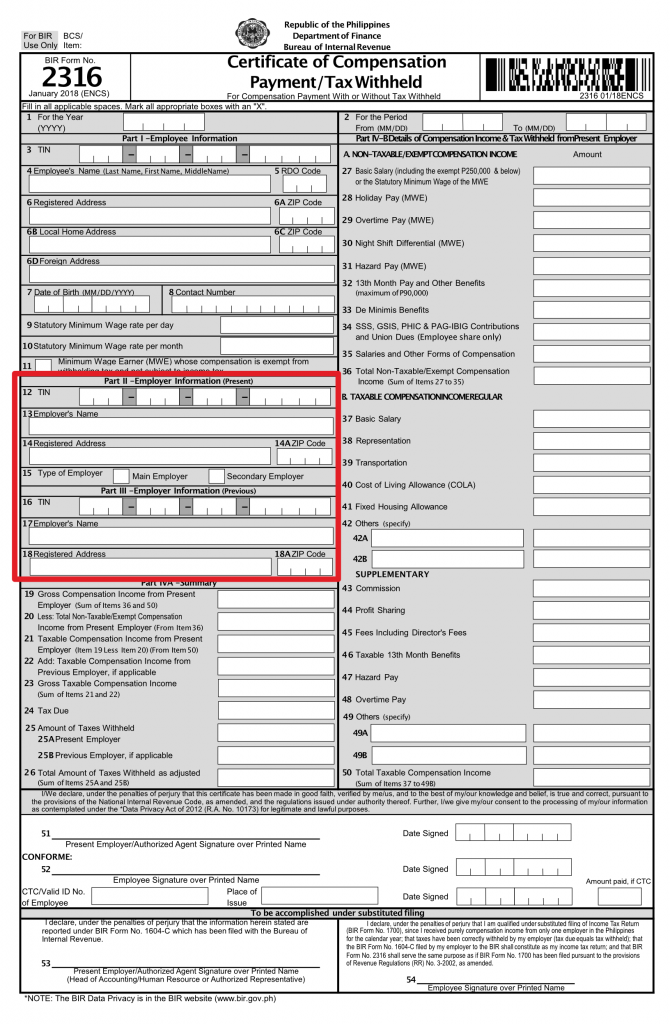

Filling out BIR Form 2316: Part II & III

- Items 12 to 15 require the details of your company as the employer on record. You need to fill this out. You can refer to your COR (BIR FORM 2303) for all the required details here if you do not have the information handy.

- Select “Main Employer” if the employee works for you full time and has no other employer on record. Otherwise, choose “Secondary Employer”.

- Fill out Items 16 to 18A only if your new hire gave you a copy of their BIR Form 2316 from their previous employer.

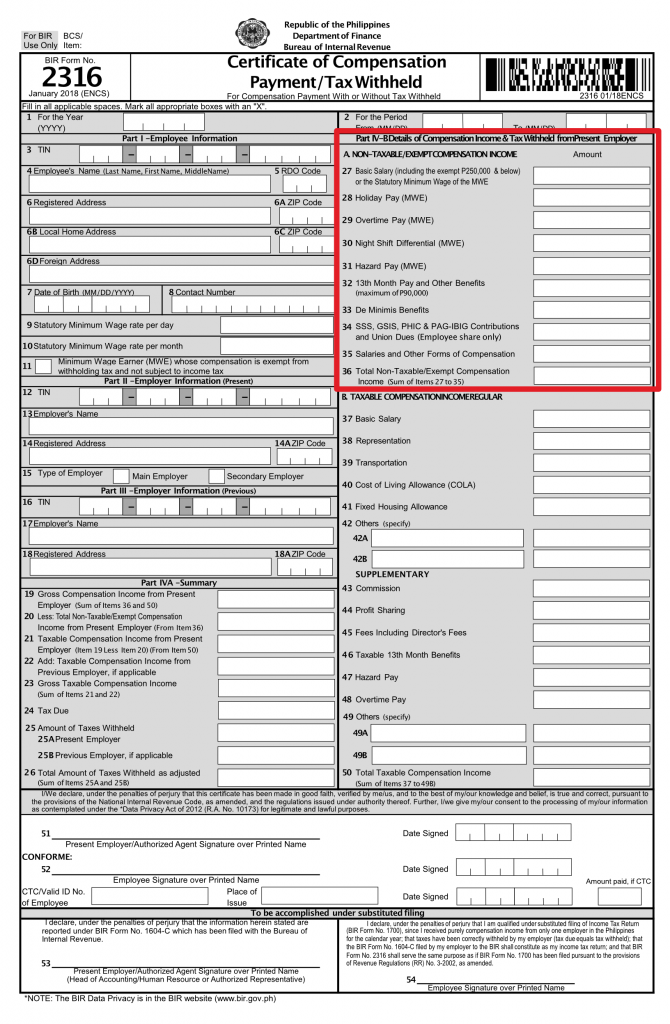

Filling out BIR Form 2316: Part IV-B (Non-Taxable Portion)

- Items 27 to 31 are only applicable if the employee is a minimum wage earner. If he is, these are the only parts you need to fill out for this section. Once filled out, go to Part IV-A. If the employee is not a minimum wage earner, leave these items blank and proceed to step 9.

- Fill out the following items only if they are applicable:

- 13th Month Pay and Other Benefit – the prorated 13th month and other non-recurring bonuses for the year should be indicated here. This item and Item 40 must not exceed Php90,000. If the sum of both items exceeds Php90,000, take out the excess and put it in Item 51 (Part IV-B).

- De minimis Benefits – indicate here any de minimis benefits extended to the employee during the year.

- SSS/GSIS, PHIC & PAG-IBIG – this is the sum of all employee contributions for the government agencies.

- Salaries & Other forms of compensation – this is the sum of all non-taxable allowances extended to the employee. This and Item 32 must not exceed Php90,000 during the year.

- Item 36 is the sum of Items 27 to 35.

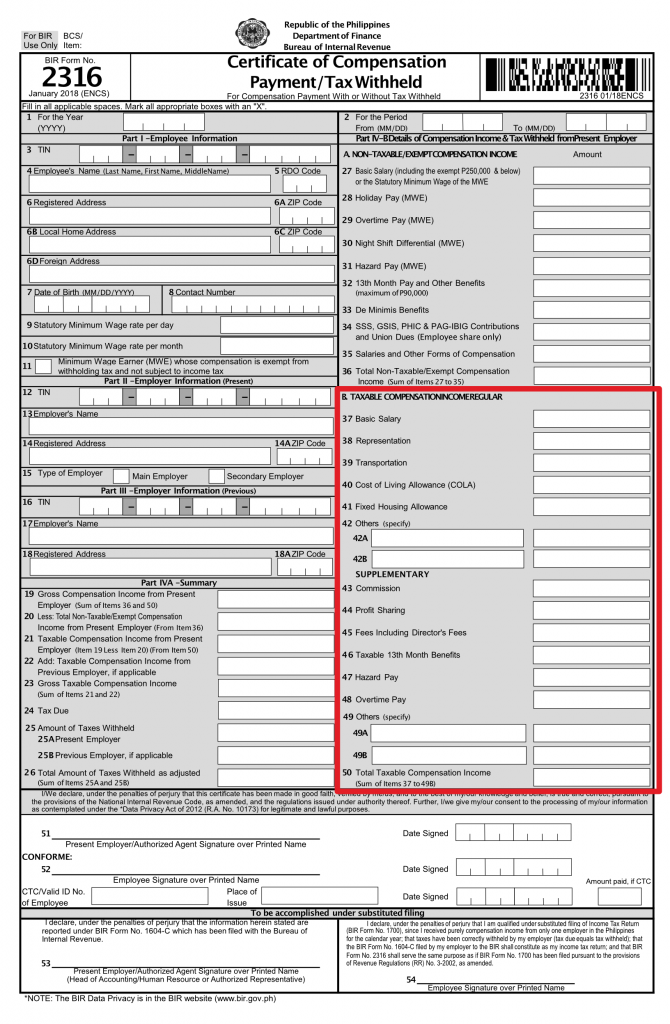

Filling out BIR Form 2316: Part IV-B (Taxable Portion)

- Basic Salary (37)– this should be the amount of the basic salary of the employee less Item 34. The employee’s contribution to SSS/PHIC/GSIS/HDMF are deducted from the basic salary as that portion of income is considered non-taxable.

- Items 38 to 41 are filled out as applicable.

- If there are other regular pay that is not indicated here, you can put them in Items 42A and 42B

- Supplementary income are those that the employee receives during the year on a case by case basis. Fill out Items 43-48 if applicable. Again, if there are other supplemental income that do not fall into those items, add them in 49A and 49B. Otherwise, leave these fields blank.

- Item 50 is the sum of Items 42 to 49B.

Filling out BIR Form 2316: Part IV-A

- Items 19-21 indicate the field where the figures should come from.

- Item 22 is only applicable if the employee has a previous employer during the year and you have a copy of her 2316. If you have, take the figure showing in Item 21 of her previous 2316.

- Item 23 is the sum of Items 21 and 22.

- Item 24 would be the tax due from the employee based on the taxable income.

- Item 25A would be the taxes withheld by you which should be the difference between the tax due and the tax withheld by the previous employer. 25B would be the taxes withheld by the previous employer, if applicable. 26 is the total of all taxes withheld (25A + 25B).

Filling out BIR Form 2316: Last Part

- Item 51 should be signed by your authorized signatory

- Item 52 should be signed by the employee with their current CTC number, place of issue, as well as the amount paid indicated.

- Items 53 and 54 are only applicable if the employee is qualified for substituted filing. The substituted filing is only for employees that do not have any other employer(s) or source of income during the year.

Prepare four copies of the 2316 and give one copy to your employee. BIR will keep two copies when you submit the 2316 in January of the following year. The remaining one copy will be for your safekeeping. Make sure you keep these in a safe place as not to misplace them in the future. It is recommended that you scan copies of your employees’ 2316 as backup.

This wraps up the ultimate guide on filling out BIR Form 2316 using the latest version of the file. Follow this guide to the dot and you should be able to sort out all those 2316 requests from your resigned employees. Remember, as an employer, you are required to provide the same to the individual as proof of their earnings and tax withholding.

If you are looking for an external team who can help you with your year-end annualization or with the calculation of taxes for your resigned employees, please fill out this form and one of our team here at FullSuite will reach out to you to discuss your options.

My son received his BIR form 2316 from his employer. Does he needs to file his income tax despite that he got this from his employer? Appreciate to receive your reply. Thanks

Hello Romeo,

If your son only has one employer and has no other sources of income, then he is qualified for substituted tax filing. This means that his employer will file his taxes on his behalf. He can verify if he is qualified for the substituted tax filing through their HR officer.

HI, I was qualified for a substituted tax filing however, my employer set a certain deadline which I missed.

Should i need to file my 2316 directly to BIR office?

Hello,

BIR Form 2316s are not filed on their own at BIR. They are supporting documents for the Income Tax Return. It is Form 1700 if you are earning purely compensation income and Form 1701 if you have mixed-income sources.

Para san po ba itong bir

Hello Omar,

BIR Form 2316 contains your income and the corresponding taxes that your employer withheld from you during the year. The form serves as a proof that (1) you have earned an income; (2) taxes are withheld from the said income during the year.