(Updated April 10, 2018 – Due date for VAT to NON-VAT registration update is April 30, 2018)

How the new TRAIN Law in the Philippines affects Freelancers and Self-Employed Taxpayers?

There has been a lot of talk about the new tax reform law, but taxpayers are still unclear on how this new Tax Reform for Acceleration and Inclusion (TRAIN) law affects them. Here´s our take on how the new law affects self-employed, freelancers, and professionals.

Percentage Tax

Under the new TRAIN law, there will be no more monthly filing of percentage tax. Instead, the filing of percentage tax will now be done quarterly. As written on the BIR TRAIN tax advisory dated February 8th, 2018:

“All taxpayers subject to percentage tax pursuant to Section 116 of the Tax Code and those who will be subject thereto, due to change of registration from VAT to Non-VAT, are required to pay the percentage tax on a quarterly basis using BIR Form No. 2551Q. There is no need to file and pay monthly percentage tax on their monthly gross receipts using BIR Form No. 2551M.”

Income Tax

Another notable change with the TRAIN law for self-employed and professionals is that there is now an option for tax rates. As written on the BIR TRAIN supplemental tax advisory dated February 19th, 2018:

“Self-employed individuals and/or professionals with gross sales and/or receipts and other non-operating income that do not exceed the above amount (VAT exemption amount of Php 3,000,000.00) have the option to avail of the eight percent (8%) income tax on gross sales or receipts and other non-operating income in lieu of the graduated income tax rates and percentage tax. These taxpayers who avail of this option have to accomplish BIR form No. 1905 (registration update) to effect the end date for their VAT or percentage tax, and as such, they are not required to file quarterly percentage tax.”

Here are the two tax rate options:

- Eight percent (8%) of gross sales or receipts and other income, in excess of P250,000 instead of the graduated income tax rates and percentage tax (no option to register for VAT); or

- Graduated income tax rates of 0% to 35% on net taxable income, plus 3% percentage tax (No change in the computation of Net Taxable Business Income).

For VAT taxpayers, there is no other option; the graduated income tax rate will still apply.

As of writing, the deadline for the registration update from VAT to Non-VAT has already passed. Per the BIR Tax Advisory dated April 5, 2018, the deadline is April 30, 2018. No deadline has been set for the registration update in availing of the 8% income tax. However, it can be expected that it should be done before the deadline for the filing of the quarterly percentage and income taxes. The deadline for filing will be on April 25th if we follow the supplemental tax advisory dated February 19th, 2018:

“… every person subject to the percentage taxes imposed under Title V of the Tax Code as amended, shall file a quarterly return of the amount of the gross sales, receipts, or earnings and pay the tax thereon within twenty-five (25) days after the end of each taxable quarter.”

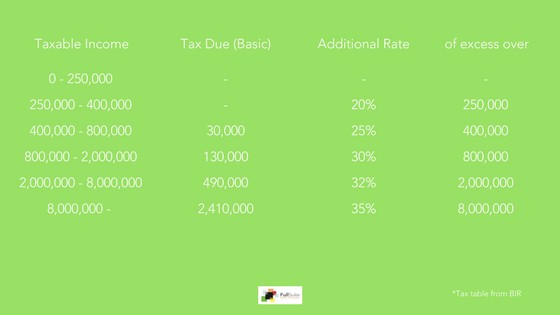

Income Tax Table

For the years covering 2018-2022 the income tax table will be as follows:

For more information about the new income tax table and other provisions as amended by the TRAIN law, please download the BIR Revenue Regulations No. 8-2018.

Hopefully, things will fully clear up with the BIR implementation of the new TRAIN law.